Stop, look, listen, think

A crazy end to a crazy month, what can we make of it all?

January was a non-stop barrage of headlines, comparable to the policy onslaught in the first few months of the Trump administration. Geopolitical events spanned the US kidnapping of Maduro, President Trump’s pressure talk over Greenland and Iran, and his ongoing push for peace in Ukraine.

Domestically, Trump called for a 10% cap on credit card interest rates, a block on US defence contractors paying dividends and buying back stock (and a cap on executive pay), while directing Fannie and Freddie to buy $200bn in agency MBS and declaring a ban on institutional investors buying single-family homes. The Department of Justice subpoenaed Chair Powell and Kevin Warsh was nominated to be the next Chair, but both the old and the new Chair face the same problem: firming US inflation and activity, despite a government shutdown in December, and the risk of a second shutdown in response to ICE agents killing US citizens.

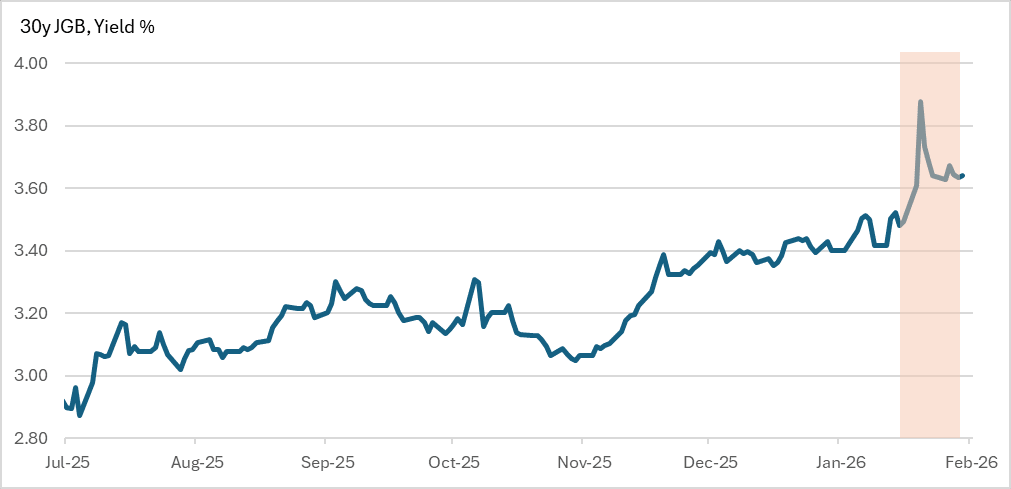

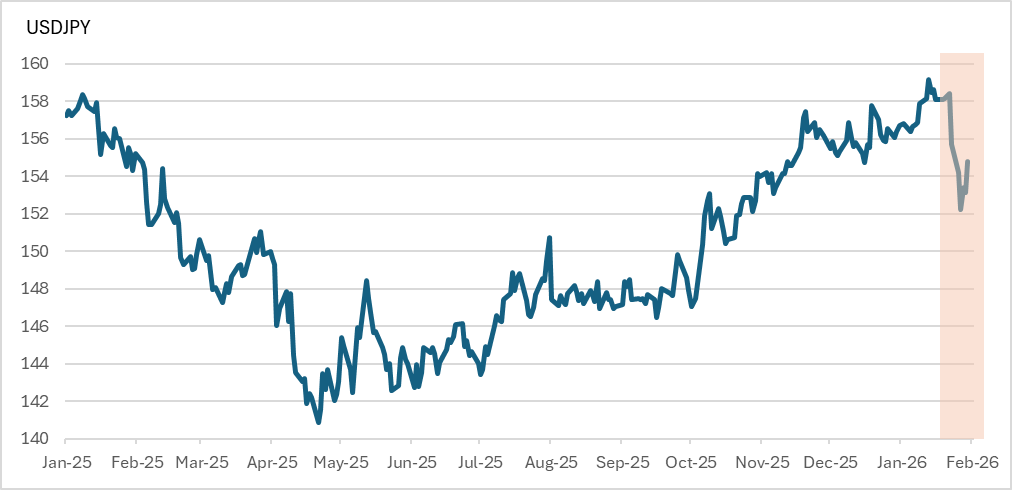

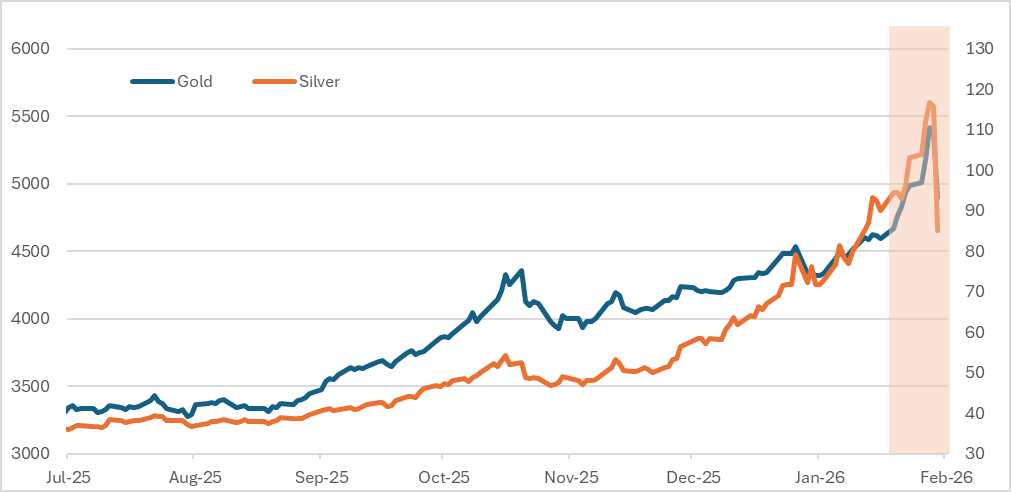

In markets, there was a blow-out move higher in long-end JGB yields after Japan’s prime minister called for elections, and JPY sold off triggering verbal intervention by both the BoJ and the Fed. That, in turn, ignited a weak-dollar narrative, contributing to a blow-off top in both gold and silver - which then suffered historic drawdowns on the last day of the month (Gold -9%, Silver -28%). A weakening dollar also prompted some to question if the ECB would be forced to cut rates in response.

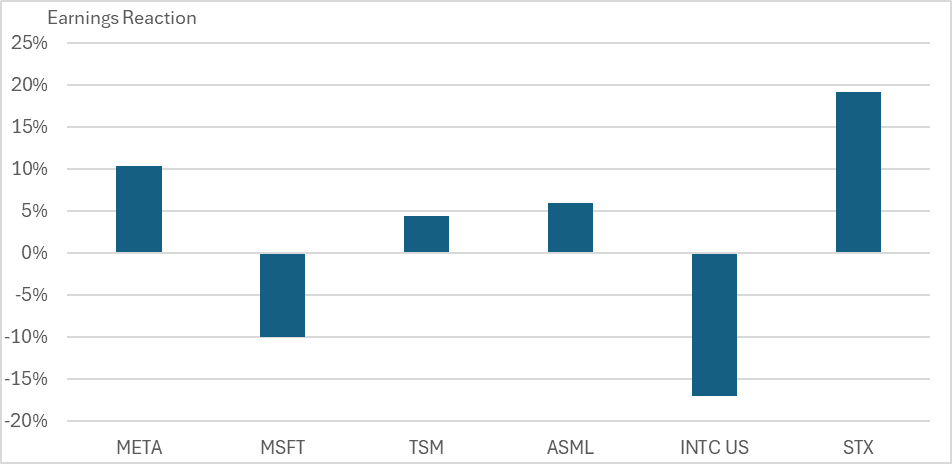

And on the corporate side, we saw significant stock dispersion on earnings from Microsoft, Meta, ASML, TSM, and so on. To that we can add in ongoing headlines regarding OpenAI’s efforts to raise their next round of capital.

With a new market theme for each working day of the month, January has been unusually exhausting. In this article, I extract some signal from the noise, with four broad take-aways from the last month, and several take-forwards into February. Valuations are even less attractive than a month ago, but the risks lie outside of credit and February is more likely to see them de-fused, than ignited.

Views expressed in this article are my personal opinions and do not reflect the opinions of any institution that I may be associated with. Nothing written in this article should be construed as investment or tax advice.

1. The TACO who cried wolf

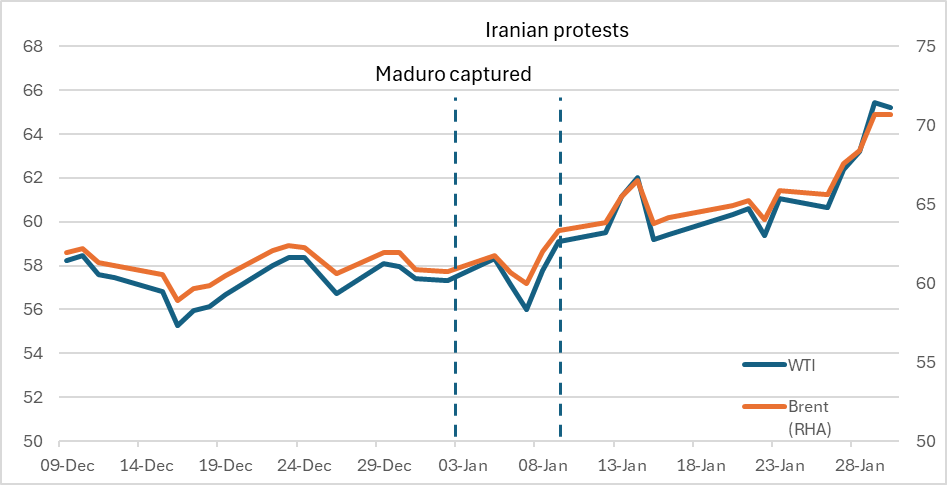

Almost all of the most aggressive, and at times bizarre, risk moments last month came from the US President: starting with the kidnapping of President Maduro and related capture of vessels transporting sanctioned oil between Venezuela, Iran, Russia, Cuba and China. While these were extraordinary actions, the operations were executed swiftly and professionally – as a result, volatility in markets hardly picked up.

There was a flurry of analysis following the events, highlighting the poor state of Venezuelan oil infrastructure and the low grade of its oil reserves. But oil prices, the most pertinent barometer, neither rose nor fell. And given the near-universal dislike of Maduro, US actions were hard to criticise despite their unilateralism. Long-term, it is unclear what (if any) plan the administration has for Venezuela – for now the US appears positioned to de facto control the country’s oil exports, but without pushing for regime change beyond Maduro as an individual.

The rhetoric toward Greenland was equally “shock and awe”, culminating in a long and widely offensive speech at Davos. And yet, to the surprise of many, a “solution” was found within hours. The whiplash for financial markets was real. The hours spent debating Trump’s demands and possible escalation/de-escalation paths were wasted.

The hours spent burning the midnight oil to identify which banks would be most affected by a 10% cap on credit card charges, how defence stocks could be affected by a mooted bank on dividends and buybacks, and implications of the Great Healthcare Plan to Lower Costs and Deliver Money Directly to the People have also been rapidly devalued by abrupt dilutions of the President’s demands.

I’ve largely avoided the TACO (Trump Always Chickens Out) narrative - mostly because I felt it gets in the way from understanding the President’s motivations. In my view, Trump has never been focused on the substantive results of his policies - he is, above all, a show man. What matters most are the headlines and the attention. As such, the goal is to coerce corporate America (and the rest of the world) into giving him policy wins that he can take into the mid-term elections.

However, there has been a palpable shift in the market’s response to Trump’s social media outbursts. My sense is that the climb-down over Greenland was so stark that the market has now fully embraced TACO. Even allowing for their limited information content, the lack of market volatility after the President threatened Canada and Korea with tariffs, and Iran with the 5th Fleet signals that investors are starting to perceive a White House that could have its wings clipped by courts and be further disempowered after the mid-terms.

2. AI spending is real

Some of you will know that I am currently moonlighting as a “tech analyst”. I haven’t yet started using chatbots to generate summaries of research on chatbot companies, but I have paid much more attention than usual to corporate earnings.

One take away is simply the size of the dispersion in performance after earnings: Meta was up 10.4%, TSMC rose 4.5% and lifted ASML 6.1%, while MSFT was down 10.0%, and INTL down 17.0%. Equity analysts might be used to this, but I am not! At a high level though, this demonstrates that the market can still reward beat-and-raise earnings1, while punishing disappointments. That implies that the market is not fully exhausted/over-extended yet.

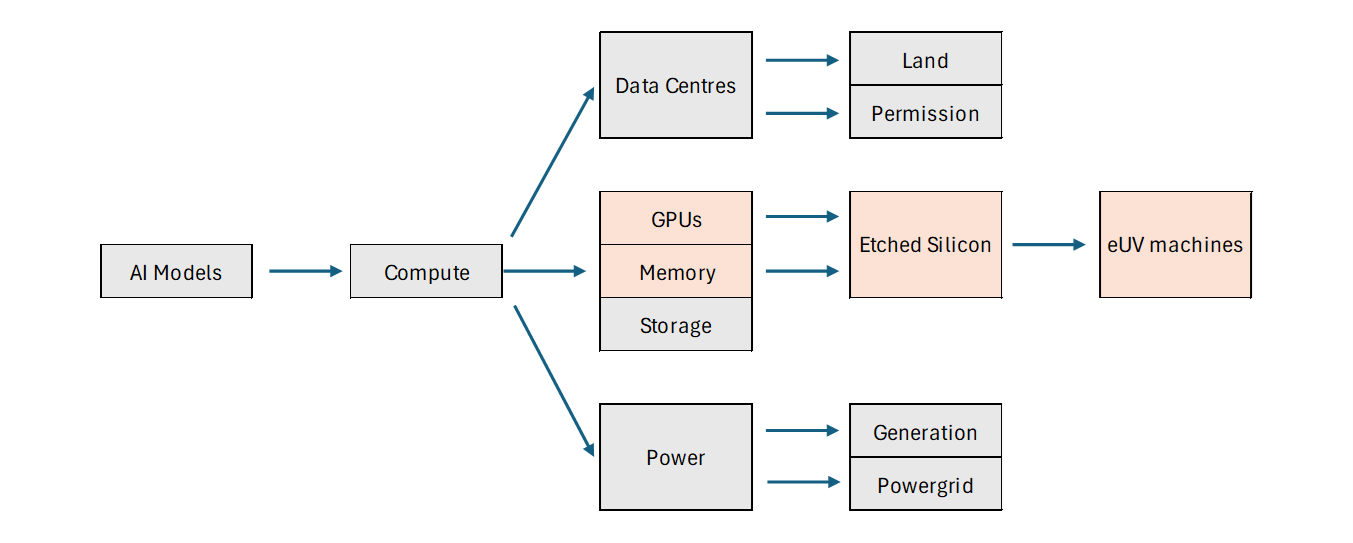

But the bigger theme for this quarter was that AI spending is real. Many things sit downstream of AI computing: land, power, a building/shell, GPUs, but also memory, storage, power generation and so on. What we saw this quarter was an extension of AI demand through the supply chain. Last year’s focus was on GPU makers: Nvidia, AMD, Broadcom. But this has moved onto memory stocks (Micron), storage (Seagate, Western Digital), silicon foundries (TSM), and even the companies who make the machines for silicon foundries (ASML).

I read this as evidence supporting my thesis that the AI spending is just starting. Last year was the year of huge, outsized announcements - but the money is only starting to be spent now. Worries about the AI bubble popping still appear premature. Macro economically, that means that the growth and inflationary impacts of AI spending are still to come and evidence continues to build that policy rates are already neutral - indeed the Reserve Bank of Australia is widely expected to hike rates next week as their economy is running hot.

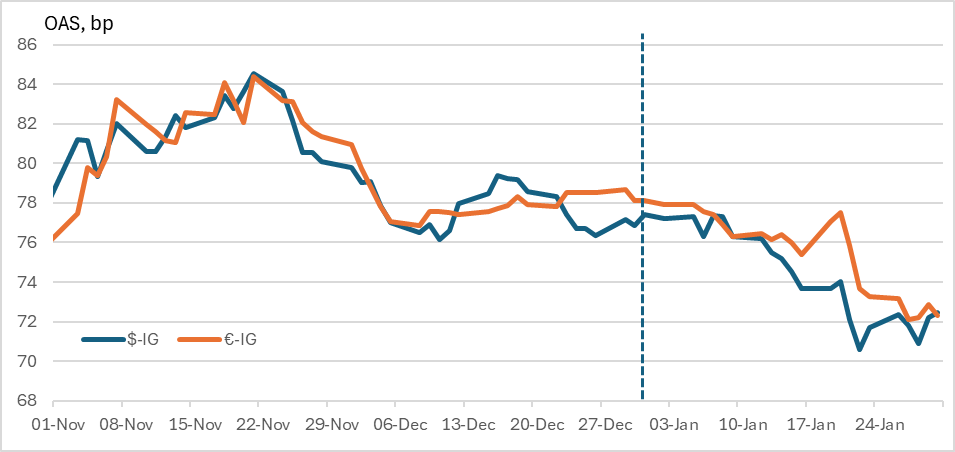

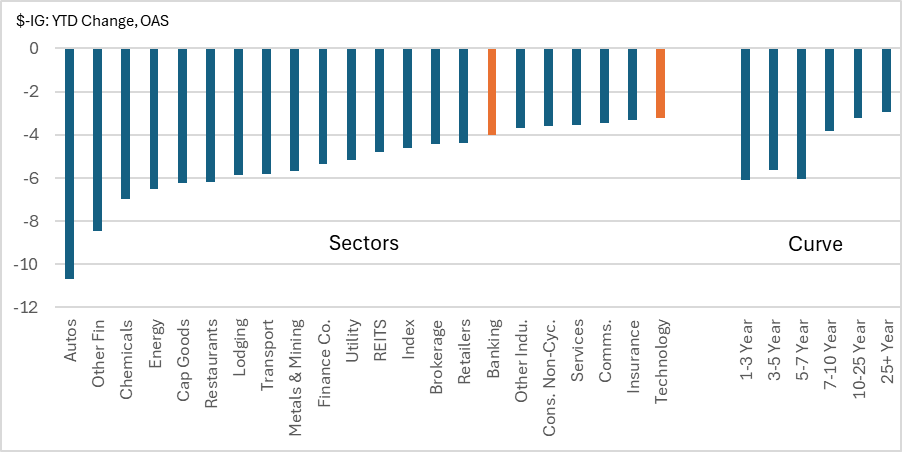

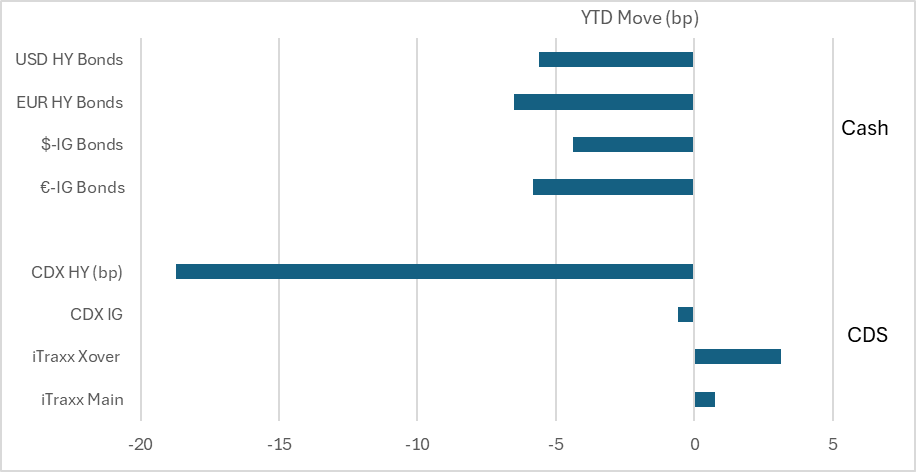

3. Demand for credit remains under-estimated

For credit markets in particular, January has also made it abundantly clear that the strength and depth of demand for the cash did not evaporate at year-end 2025. This was another of my key views coming into 2026 - that credit investors continue to underestimate the depth of demand for corporate bonds, and how tight spreads could trade. While we have not quite touched the 70bp level in indices, we did get down to 71bp and I’m happy to consider my statement that “I see more risk of a squeeze below 70bp than a move above 90bp for the cash index” as essentially validated.

That said, part of my thesis was that bond issuance would come in below very elevated expectations. That has not been the case - Tech issuance (and M&A issuance) has been limited thus far, but banks aggressively stepped into the gap. As a result, overall supply has landed pretty close to market forecasts. And the skew towards banks has (frustratingly) not done much damage to the consensus trade of Overweight Banks and Underweight Technology: instead both sectors have underperformed the general tightening of the cash index in January. Likewise, the long end has underperformed in anticipation of Tech supply, which would now need to come in February (if at all).

That said, the performance in Tech names has started to bifurcate, with the early-January deal from chipmaker Broadcom trading well and this week’s issuance from IBM pricing with only a small concession. But names where issuance is still expected, META and ORCL, have struggled.

What has worked better were some of the macro expressions of trading against consensus, such as long cash bonds and short CDS indices - the opposite of what was implied by the “supply will overwhelm” narrative. Likewise, there has been no real steepening of credit 10s30s, though short-dated spreads have outperformed.

The demand for corporate bonds will be tested more sternly in February, even as supply drops off, with demand likely to ease for various reasons. But over the year as a whole, the continued recycling of cash out of a rising equity market and back into bonds is likely to keep frustrating those fixated on the absolute level of spreads.

4. There is liquidity chasing bubbles

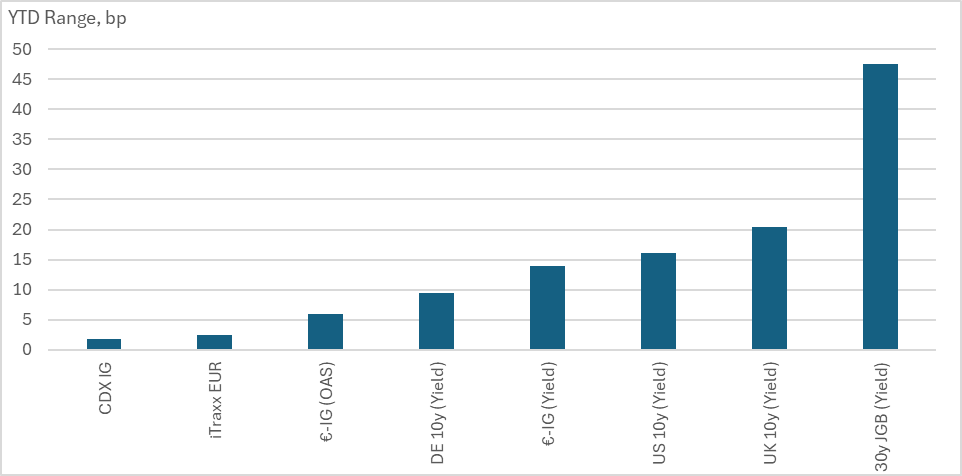

While US/Trump policies have been the loudest by far in January, taking a step back, I find it interesting to note that the announcements that had the most impact on market prices came from Japan - with long-end JGB yields rising sharply after Prime Minister Takaichi called snap elections. Takaichi is widely expected to win a large majority, allowing for fiscally expansive policy this year - putting upward pressure on JGB2 yields, and downward pressure on JPY.

In response to the weakening JPY, the BoJ and the Fed started checking market prices - a signal to potential intervention - triggering a sharp reversal. While there is no evidence of physical intervention (selling USD to buy JGBs), the “verbal intervention” was highly effective with USDJPY falling from 158 to almost 152.

However, it also triggered a “weak-dollar policy” narrative - the idea that the US is actively pursuing a weak dollar. This both led to a discussion over the semantics of co-ordinated interventions and, more importantly, it added fuel to the rampant run-up in gold and silver prices which started trading like meme-stocks, rising aggressively and really challenging my thoughts on gold from last year.

And then Trump announced Kevin Warsh as his nominee to be the next Fed Chair. Speculation over which arch-dove would get the seat and lower interest rates for the President has been rife since the middle of last year, including discussions over whether the President could “fire” Chair Powell - questions that were amplified when the DoJ issued a subpoena to the Fed Chair. So the nomination of Warsh, who has been an extreme hawk3 throughout his career at the Fed, was a shock.

Warsh’s nomination appears to have triggered record liquidations in gold and silver on the last working day of the month, with gold seeing intra-day falls of 14%, and silver falling 38%. I may have exited gold 20% before the highs, but I have no regrets.

Bigger picture, what stands out is the speed at which headlines become narratives become price action. I’m tempted to put the moves in gold and silver into a larger context, in which we have seen speculative bubbles in Crypto, then in AI stocks, then in AI beneficiaries, and then in precious metals. It’s a qualitative observation, but it seems too much of a coincidence that we have had rolling, mini-bubbles across several asset classes in quick succession.

Safe to proceed, while looking both ways

January was wild. Almost every single day had a new headline, a new narrative, and a new price move. And yet at the end the month credit is tighter, making new post-GFC tights in €-IG and $-IG and with almost none of the volatility seen in other markets. That speaks loudly to the second theme in this article: that demand for credit is deep and robust. It also reinforces a larger narrative that I have been pushing since late 2024 - that this is not a credit-led market or a credit-led cycle.

And I believe, as laid out above, that there are signals we can extract from the noise. First, I believe we have crossed a threshold with regard to the ability of the President to move markets - investors are paying less and less attention, after one too many TACOs. I’m not saying that US policy can be ignored, but the price impact of Trump’s outbursts is likely to diminish further unless and until the pattern is broken.

Second, it is still far from clear if revenues and earnings will ever justify the vast amounts of AI spending that is planned, but the answer to that question lies years away while the money is being spent now. We will not get the answers in February or (likely) March. But we could see another fund-raising round for OpenAI which would substantially de-risk the AI investment nexus. And for credit markets we will finally see what tech issuance this year could look like - I still believe expectations are high and there is room for tech supply to underwhelm.

Third, and finally. If there is a worrying pattern emerging it is the speed at which a headline becomes a narrative, and a narrative becomes price action. A rising number of asset classes are seeing 10% one-day moves, something that used to be the preserve of bitcoin. This price action is not observable in credit, so I have no edge - but it implies that speculative sentiment is high in financial markets.

When a company announces better than expected results and raises guidance for future quarters.

Japan Government Bonds

A central banker that leans towards higher interest rates and tighter monetary policy to avoid inflationary risks.

Great post! Perhaps this is a bit forward looking but regarding section 2 & 3 (AI capex and credit demand, specifically IG), do you think we'll face a bit of a 'crowded exit' problem in credit markets, especially in/around tech later this year (a lá silver + gold liquidity events)?

Edit: mainly asking as you spoke on bifurcation of tech valuations - which I also highlighted in my latest (very long) piece on AI inference and who will capture value as inference costs drop.

Excellent synthesis of January's chaos. The observation about rolling mini-bubbles from crypto to AI stocks to precious metals is spot-on. What's interesting is how each asset class absorbs excess liquidity untill it hits that inflection point. I watched the gold selloff and it felt like classic late-stage speculative behavior where everyone knows its overheated but nobody wants to exit first.