Two sides of the same Bitcoin

A vector for criminality or a hedge against fiat debasement: why not both?

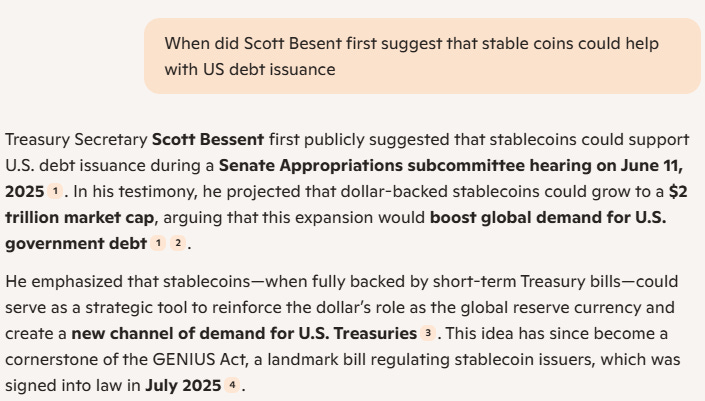

With the GENIUS Act signed into law, the current US administration continues its “move fast and break things” bear-hug of cryptocurrencies. Whether stablecoins can single-handedly take down trillions of US debt deserves its own article, and some number-crunching on my side, but I will point out that the idea of stablecoins counter-balancing the fiscal profligacy of the One Big Bill only cropped up in the last few weeks. In contrast, the STABLE Act was drafted in February and stablecoin regulation has been in the works at least as far back as the de-pegging of Tether in 2020 (and the collapse of Terra in 2022).

Co-Pilot: 20/07/2025

There are many things I find fascinating about cryptocurrencies, which I have been loosely tracking since 2012, but it has long been clear that, by and large, they were a solution looking for a problem. As a result, the rationale for owning crypto has been in constant flux. Originally BTC was an computer-science novelty (solving the Two General’s problem) and a hedge to USD debasement via QE in 2010 (remember that?). Over time crypto has also been touted as the future of finance, a payment rail for the dark web, a meme (literally), a core allocation for pension funds (!?), and more.

In my mind, the chimeric arguments for crypto reflect two key narratives that have come into tension with one another:

By operating outside of the existing financial system, cryptocurrencies originally promised both a shelter from government laws and a shelter from government collapse. As a result adoption was rife in low-trust, low-law countries such as Russia, China, North Korea, and various other EM countries. In this sense, widespread support in the US was a surprise (or, perhaps, a warning).

Because price is a social construct, adoption is value. As cryptocurrecy adoption rose so did cryptocurrency valuations. But most people don’t want value that is trapped outside of the world in which they live. As a result, the wild success of crypto actively undermined its original value proposition: more and more of the cryptowealthy wanted to move their ‘money’ off the chain and began to push for legal frameworks and safe harbours for their digital wealth.

The institutional adoption of cryptocurrencies by the Trump administration is the convergence of declining governance in the US (because the US is an EM) and the increasing success of the cryptoverse in embedding into the world of “traditional finance” (or TradFi, as it the Defi community call it).

As such, even for the uninterested/uninvolved, I think there is value in keeping one eye on developments in the cryptocurrency space as part-and-parcel of tracking the US political economy. Or even owning some.

The three times I bought BTC (or at least tried)

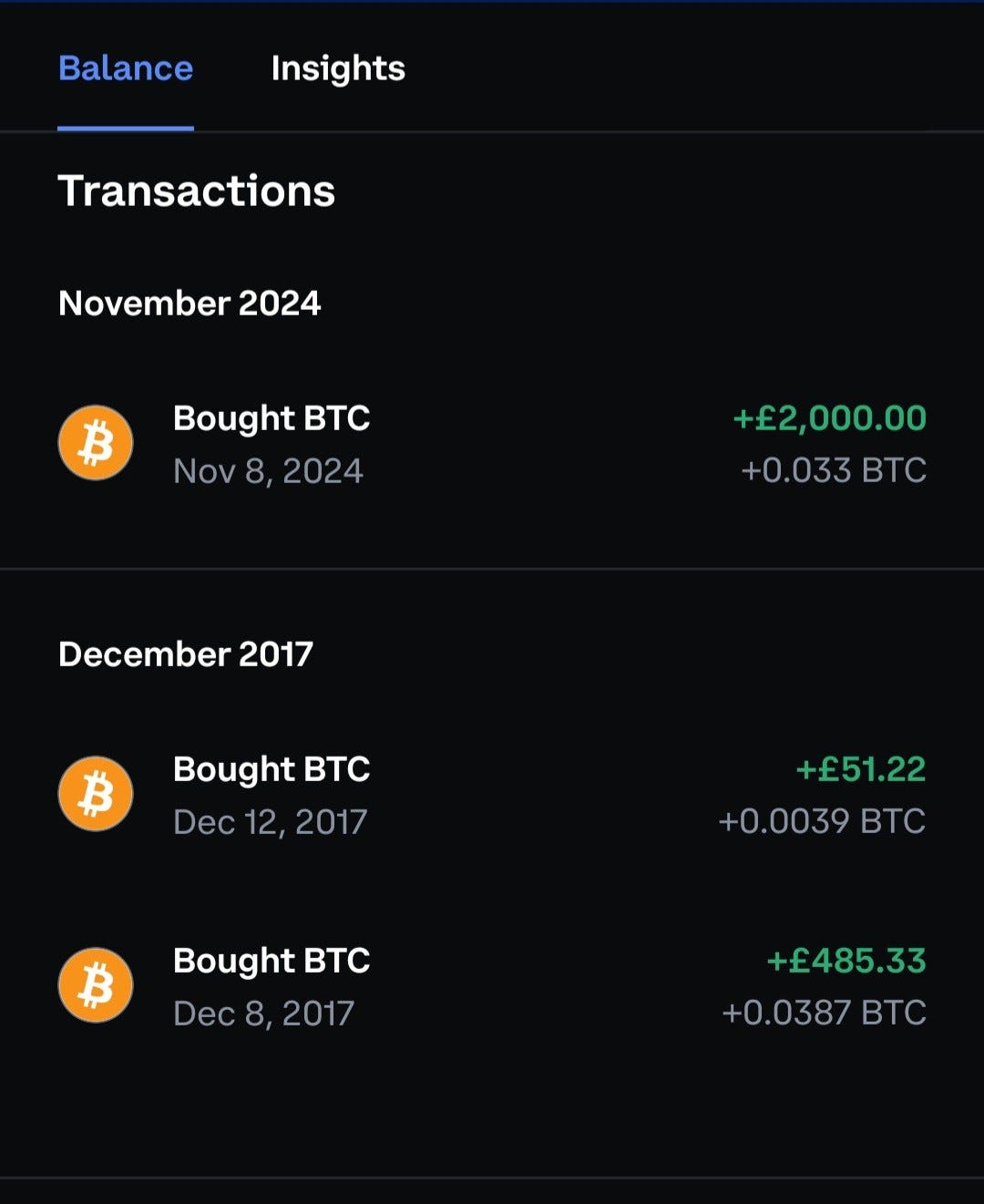

I have attempted to buy BTC three times, only two of them successfully: 2013, 2017, and 2024. Each time the thesis was different and sadly (for me) in 2013 I was stymied by repeated requests for high-res scans of my passport from a Cayman Islands based FX platform that I found via Google. Eventually I gave up, figuring that identity theft was more risk that I was willing to wear.

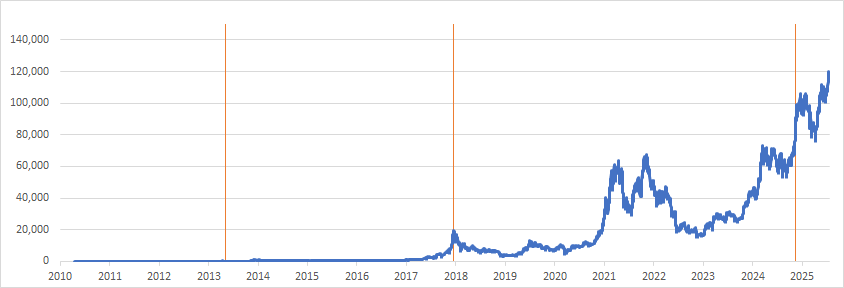

My three conviction buys on BTC

https://charts.bitbo.io/price/

Thesis 1: Faith based investing

When Bitcoin first came on the scene (in computing circles) the cynicism was deep and well founded. I was also a sceptic, but what struck me was that the original BTC crowd were true believers - diamond-handed HODL'ers who were convinced that QE would trigger an age of hyper-inflation and currency debasement, leading BTC to replace all fiat currencies.

It is widely understood that faith is impervious to facts. Indeed, when presented with facts that contradict their beliefs, people overwhelmingly double-down on the side of beliefs. And that was my thesis: that there were enough people pointing out how BTC was nonsensical that the BTC believers, who were the only ones involved in the market such as it was, would double-down on the idea.

Unfortunately, unless you mined the stuff, it was remarkably hard to buy BTC in 2023, particularly from the UK.

Thesis 2: Bubbles make everyone look stupid

By the time 2017 rolled-around, crypto was making new highs. BTC topped $10,000 and I was doing the mental math on how I could have retired at 34 if I had just been more dogged in emailing my passport to the Cayman Islands (+10,000%).

Some people were getting rich in crypto and many other people were noticing. Indeed, even in my corner of investment-grade credit, clients were suddenly asking me what I “thought about Bitcoin” during meetings. Due to my earlier dabbling, I was probably one of the more qualified people to say anything on the matter, and even contributed on the technical side to a cross-asset report on BTC towards the end of 2017.

While the lead author argued that BTC had already reached max adoption and so max price (whoops!), I had a simpler take. Bubbles are equal-opportunity pain: you can look stupid on the way up, by not being involved; or you can look stupid on the way down when you lose your shirt. Only a few manage to get out (and stay out) near the top. This time around I chose to buy in because the pain of prices exploding higher a second time would have been too much for me to take: plus the stakes were £500. It was an emotional hedge.

Thesis 3: Corruption and safety rafts

My most recent purchase of BTC rests on third, but again simple, thesis. Over the course of 2018-2020 the crypto-ecosystem had re-oriented itself from being inward facing and confrontational, to being outward facing and compliant. With hindsight, I was both aware of this and ignored it - though partly because I had spoofed-myself into buying a sizable (for me) position in the Hedera alt coin in 2021, and I was stuck warehousing a significant draw-down*.

The crypto lobby spent years pushing for what it referred to as “on-ramps”, to make it easier for people to ‘invest’ in crypto. I referred to them as off-ramps. There was a sizable community of people who had huge paper wealth due to the run up in prices and were now less interested in HODL and more interested in cars and houses (see, for example, this FT article). These individuals wanted ways to get their wealth off the blockchain and into the real economy which meant that, instead of being antagonistic to regulation and regulators, crypto-exchanges started pushing for regulatory clarity to ensure the legality of wealth transfers. Wealth managers started pressing for ways to onboard newly minted millionaires as clients and so on. Eventually we even got bitcoin ETFs, which were a runaway success.

This multi-year effort to wire crypto in the existing financial system has sped ahead since the election of President Trump, who has repeatedly delivered for a community that unashamedly supported him last year. Alongside the GENIUS act there have been other rewards for crypto-maximalists such as the US Strategic Bitcoin Reserve, and the pardoning of both BitMEX and the man behind Silk Road. The President also got in on the action with his Trump coin (and then Melania coin).

So am I long corruption? A little bit.

But holding BTC is part of my broader thesis that the US is an EM. In this framework BTC serves three useful purposes for the Trump administration:

It has brought his campaign money and votes, as the cryptoverse was overwhelmingly pro-Trump in 2024. Promises made, promises kept.

It has brought him even more money. The de-facto legalisation of crypto while paired with light-touch regulation has created a wonderful channel for donations to President Trump (Legal Eagle has a strong take on this).

It’s a safety net for the rich and connected if Trumponomics goes wrong, harking back to the original fear that spawned Bitcoin.

My BTC purchase in November 2024 rested on (1) and (3). Populist Presidents love growth and a core view of mine coming into 2025 was that the US would continue to hyper-stimulate its economy with implications for rates (bearish), equities (bullish), and credit (bullish). This also weaves into an (even larger) thesis of mine, that Fiscal Dominance is back for this decade, but I digress. The One Big Beautiful Bill confirms that the US is likely to keep running a large, highly stimulative deficit for the rest of this presidency as I expected.

So far, so good. The US continues to spend, the economy powers on, and risk assets rise. What’s the problem? Well if life were so easy, governments around the world would not have turned to austerity post-GFC. But running a huge deficit in a pro-cyclical manner has historically had significant long-term costs, literally and figuratively. In particular, it tends to end in either a debt or currency crisis, or both - often via inflation, a bubble, and a crash.

With this in mind, embracing crypto is also is a hedge for the ultra-wealthy that surround the president and who cheered his tax cuts**. If the economy generates a blow-off top, then these people will benefit from their existing investments and/ from being close to the President. And if it all goes wrong, then BTC might even deliver its original value proposition from 2010 - as a hedge to a fiat dollar (though this is far from certain given that BTC has become highly correlated to the SPX).

So from an investment perspective, I still think that (even at these levels) owning BTC is an interesting way to own both tails. There is the potential for further gains if BTC sees continued adoption on the basis of past returns and greater legal clarity (or if there is a blow-off-top in US equities), but it may also outperform the USD if the administration hits exit velocity with regard to inflation, fiscal dominance and eventually dollar-debasement. Or if they fire Powell.

In some ways, BTC can be viewed as an inverse-UST: it is likely to do well in periods of high nominal growth and/or sovereign crisis. The downside risk is that neither of the above tails are realised: a final puff as the asset class is adopted and becomes a zero-yielding, low-volatility commodity, or if there is a regular-way US recession. But in that case USTs are probably rallying nicely.

*This eventually paid off in 2024 for about +200%, confirming that my HBAR position was giving me a material beta to BTC anyway.

** I refer to this as the looting phase.

*** If anyone is wondering why I wrote all this but I am not swimming in crypto wealth, those BTC trades in full are below. The bigger payoff has been the amount I have learnt from being involved in the conversations: